Investment Advisor Test

Investment advisor tests are designed to assess a candidate’s aptitude in the skills necessary to be an investment advisor.

An accounts receivable specialist is a member of the finance department that helps maintain financial accounts, specifically with incoming transactions. They need to have specific skills and knowledge around finance, including invoicing and reconciling incoming payments.

Try for freeThe accounts receivable test is a pre-employment assessment designed to give candidates who have applied for an accounts receivable role the opportunity to demonstrate that not only do they have the right level of skills, knowledge, and competencies, but that they can apply these in a workplace situation.

This particular test assesses candidates based on the specific skills and knowledge that is essential to success when working in accounts receivable, ensuring that the applicants have what it takes to be able to deal with day-to-day financial transactions and work directly with customers and clients to ensure that invoices are paid promptly.

Recruiters are using this test more commonly because it is simple to administer and can be shared with a large number of candidates at the same time; each candidate answers the same questions in the same environment, so the results can provide unbiased, objective data that the recruitment team can use to only select the applicants who have what it takes to be successful.

The accounts receivable test is a straightforward assessment that is structured to ask questions based on the specific skills and knowledge that a successful accounts receivable specialist needs. These skills include excellent numeracy and understanding of financial terms and practices, as well as good communication and logical thinking.

With the accounts receivable test, recruitment teams can see exactly which candidates have the required level of skill and can apply their knowledge to real job situations - which means that they are more likely to be successful in the role if they are hired. The candidates who score highest in the test are top performers, which makes them the ones who should be taken further into the recruitment process.

An accounts receivable specialist should meet certain requirements before they are hired, and the specifics will depend on the individual circumstances of the company. Most recruiters look for a certain number of years of experience in a similar role, or qualifications like a degree in something like math or accountancy, or a qualification from the Institute of Chartered Accountants such as an Associate Chartered Accountant.

While these are good indications of knowledge, and can be easily assessed through a simple paper sift, it is difficult to ascertain the competencies and skills that make a candidate successful as an accounts receivable specialist. This is where choosing to use an accounts receivable job knowledge test will make a difference in the quality of candidates that are taken through to interview.

With the accounts receivable test, you will be able to tell which candidates are proficient and accurate at data entry and can maintain spreadsheets and other records. You will be able to see which can record and reconcile all incoming payments, create and chase invoices, and accurately update client records.

The accounts receivable test also allows the candidates to demonstrate that they have the right communication skills to be able to liaise with customers and clients, and that they can work as part of a wider finance team for the benefit of the company.

The accounts receivable test would also be suitable for use when hiring an accounts payable specialist, or for smaller businesses it might be useful if recruiters are looking for an accounts assistant who might be expected to take on a few different roles in the finance department.

Recruitment teams use the accounts receivable test early in the recruitment process because it is a useful tool to filter through a large pool of similarly qualified candidates to focus on the applicants who actually have the skills, competencies, and aptitudes, and can apply their knowledge to actual job-based scenarios.

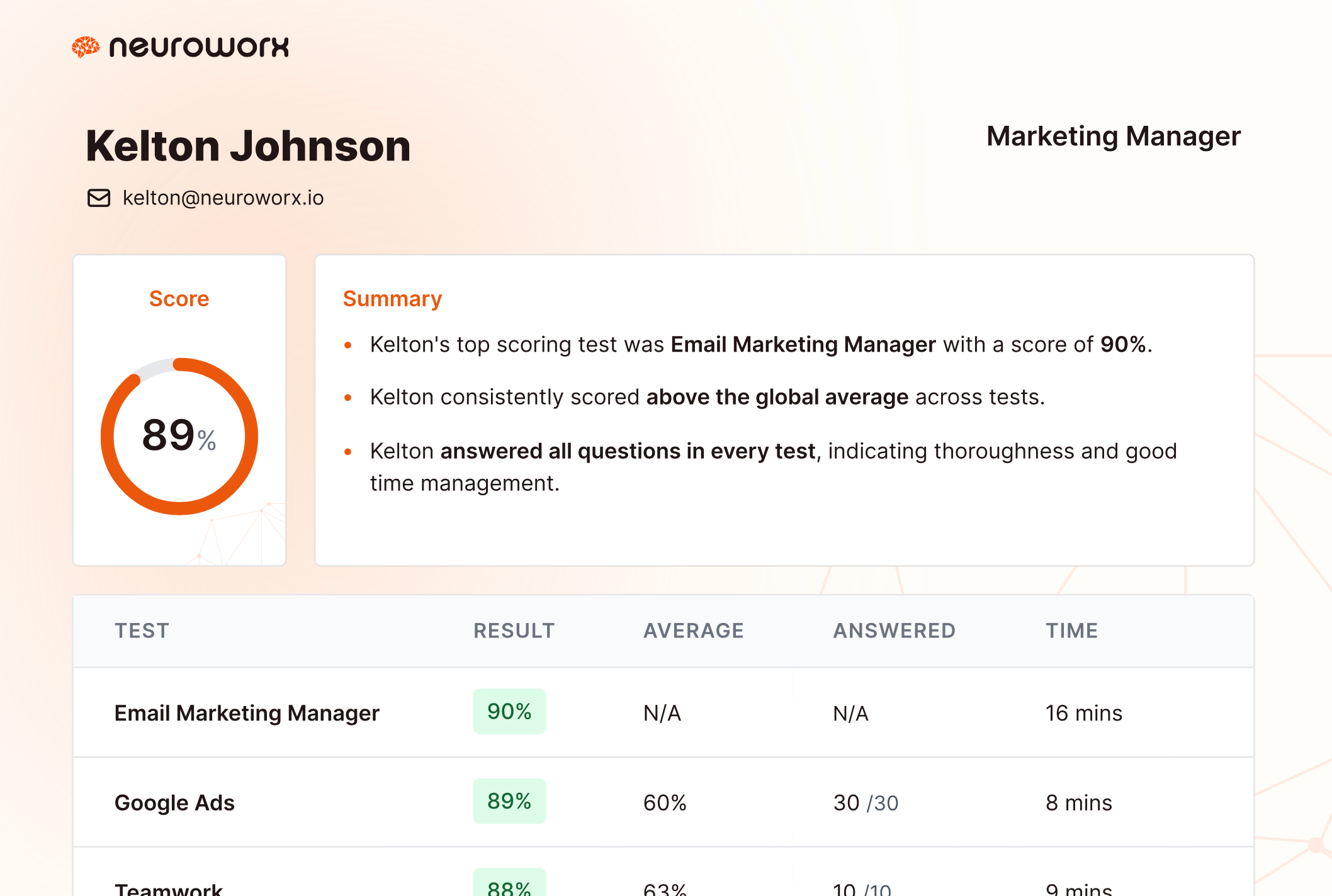

Results for the Accounts Receivable Test along with other assessments the candidate takes will be compiled to produce a candidate report.

The report is automatically generated and available both online and as a downloadable pdf so they can be shared with other team members and employees alike.

Candidates will need to answer a range of questions that measure industry-specific technical skills where applicable (e.g. Microsoft Excel), soft skills (e.g. accountability), aptitude (e.g. situational judgement) and relevant personality dimensions (e.g. consideration). The results present a holistic view of how well-suited each candidate is for the job at hand, using a data-driven approach.

The format varies by type of question, including multiple-choice for aptitude and technical skills, situational judgement for soft skills and agreement on a Likert scale for the personality dimensions. This approach ensures candidates are being assessed in an accurate and fair manner, and that results reflect the true underlying qualities of each candidate.

The characteristics, abilities and knowledge necessary to be an accounts receivable specialist were identified using the US Department of Labor's comprehensive O*NET database. O*NET is the leading source of occupational information that is constantly updated by collecting data from employees in specific job roles.

During the development process, test questions were rigorously analyzed to maximize reliability and validity in line with industry best practices. They were created by our team of I/O psychologists and psychometricians – who collaborated with subject-matter-experts – and field-tested with a representative sample of job applicants who have varying experience, just like you might find in a talent pool.

Each test is reviewed by a panel of individuals representing diverse backgrounds to check for any sensitivity, fairness, face validity and accessibility issues. This ensures each candidate has a fair chance of demonstrating their true level of expertise.

Our accounts receivable test is monitored to ensure it is up-to-date and optimized for performance.

Our test platform

Our platform offers an extensive library of hundreds of tests, giving you the flexibility to select and combine them in any way that suits your hiring needs. From understanding specific role requirements to assessing general cognitive abilities, our diverse library ensures you can tailor your assessment process precisely.

To work in accounts receivable, a candidate needs to have excellent mathematical skills and be proficient at data entry. They also need to be logical and analytical, with excellent communication skills to be able to work with customers, clients, and other team members to ensure invoices are paid and recorded correctly.

Recruitment teams might want to use some other tests to really focus on certain skills; these might include numerical reasoning for the application of arithmetic skills, or error checking specifically for data entry. Communication skills tests are particularly useful if the accounts receivable specialist is likely to be dealing directly with customers or clients.

Neuroworx operates on a monthly or annual subscription basis. We have several plans to suit your hiring needs, which you can check out here. Alternatively, you can get in touch with us to discuss a custom plan.

Yes, simply sign up (no credit card is required) and we'll give you unlimited access for seven days. Create as many jobs and test as many candidates as you want; you won't be charged a penny.

Investment advisor tests are designed to assess a candidate’s aptitude in the skills necessary to be an investment advisor.

A restaurant manager test is designed to evaluate whether job candidates have the core skills and essential traits to be effective restaurant managers, responsible for the operations of a restaurant.

A financial analyst test is designed to help employers assess whether a candidate has the requisite skills and expertise to successfully perform as a financial analyst.

Assess a Physical Therapist's decision-making and interpersonal skills through realistic patient scenarios.

Talk is cheap. We offer a 14-day free trial so you can see our platform for yourselves.

Try for free